The UK Government has developed a series of business support actions that really help UK based companies innovate new products and processes and reward those that commercialise them. In order to protect innovations it may be possible to secure a patent and stop third parties from copying concepts and ideas. The UK has introduced a support action called ÂPatent BoxÂ. This is a terrific way of rewarding those companies that innovate and patent protect their ideas and go on to commercially exploit them.

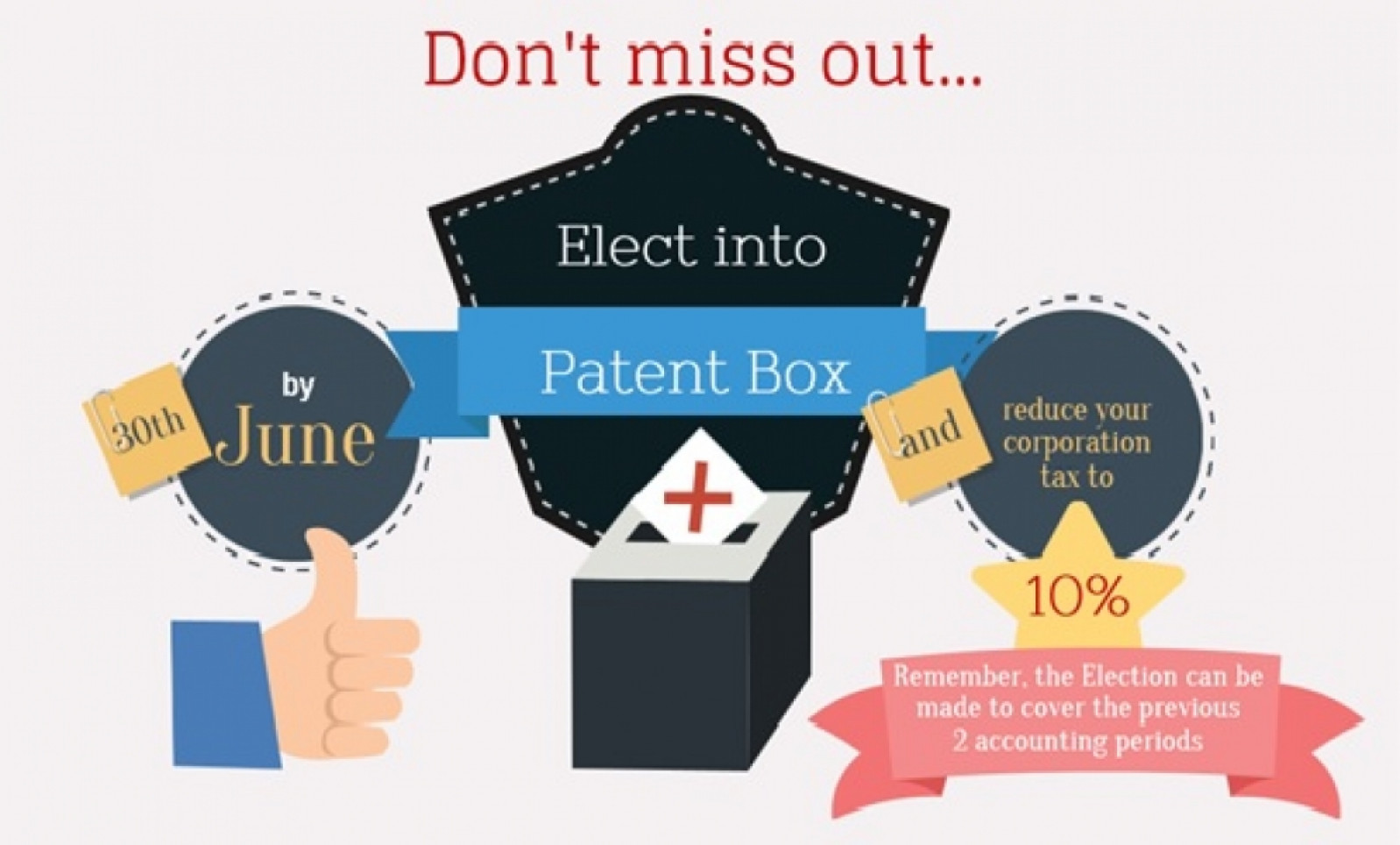

This has now been inforce for a number of years and the generosity of the scheme has been challenged in the EU and wider afield. A compromise Patent Box has been agreed and comes into force on July 1st 2016. This is more complex to access and less generous. However, it is still very worthwhile taking advantage of.

Current scheme ending...

Patent Box has now been inforce for a number of years and the generosity of the scheme has been challenged in the EU and wider afield. A compromise Patent Box has been agreed and comes into force on July 1st 2016. This is more complex to access and less generous. However, it is still very worthwhile taking advantage of.

What is the benefit of claiming?

In a nut shell, a company is able to reduce their corporation tax to 10% on all profits arising from products and processes that incorporate a patented aspect. An example may be a novel patented DVD reading device. When installed into PCÂs, Laptops and DVD machines the corporation tax on profits of the whole PC, Laptop etc are paid at 10%. Patents do not need to have been granted and the benefit is accrued until it is granted. You only need a UK patent to take advantage of the scheme even on worldwide sales where the tax burden is within the UK.